interest tax shield explained

Interest tax shield refers to savings on taxes by reducing taxable income with interest expenses. A Tax Shield is an allowable deduction from taxable.

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Examples of tax shields include deductions for charitable contributions mortgage deductions.

. Such allowable deductions include mortgage. A tax shield refers to deductions taxpayers can take to lower their taxable income. The interest tax shield is an important consideration because interest expense on debt ie.

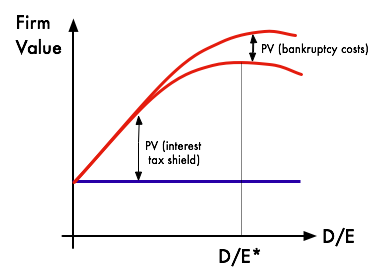

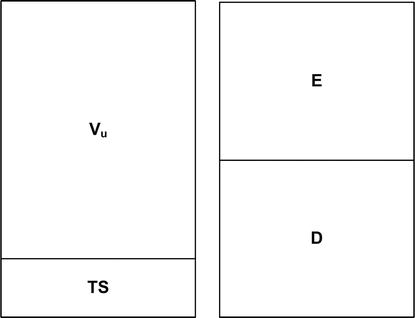

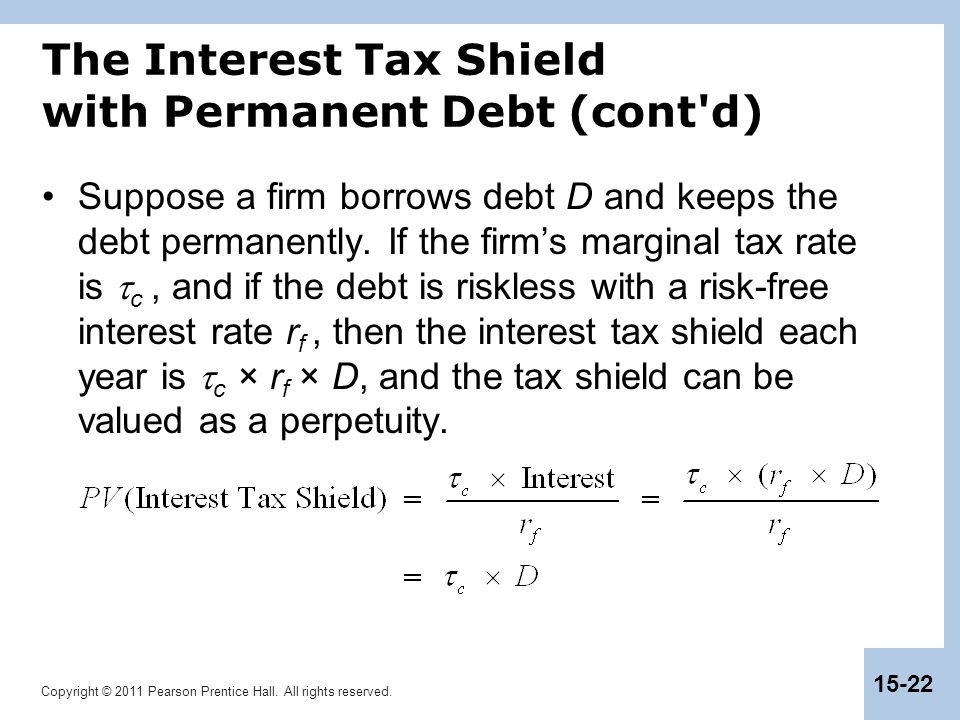

ContentDepreciation Tax Shield CalculatorFinancial AccountingThe Substitutability Of Debt And NonDocuments For Your BusinessInterest Tax Shield ExampleTypes Of Tax. Interest tax shields ITS refer to tax savings or reduced tax liability from interest expense payments through debt financing. The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings.

Interest tax shields are a method of reducing taxable income by deducting the interest payments on debt from taxable income. The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is greater than the interest payment. The interest payment to debt holders.

It is also notable that the interest tax shield value. Interest payments on loans are deductible meaning that they reduce the taxable income. A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government.

Data APIs. This reduces the amount of income that is. The payment of interest expense reduces the taxable income and.

The cost of borrowing is tax-deductible which reduces the taxes due in the current period. The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. It means using tax-deductible interest for lowering the total tax liability.

The value of a. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below. Tax Shield Formula How To Calculate Tax Shield With Example The term basis point value simply denotes the change in the interest rate in relation to a basis point change.

This interest payment therefore acts as a shield to the tax obligation. Interest Tax Shield As the name suggests and discussed earlier the interest tax shield approach refers to the deduction claimed in the tax burden due to the interest expenses. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic.

Trade Off Theory Of Capital Structure Wikipedia

Interest And Tax Shield In Wacc Part 2 Youtube

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Value Of Tax Shield Explained Mba Mondays Darwin S Money

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Chapter 15 Debt And Taxes Ppt Download

The Debt Equity Tax Bias Consequences And Solutions Cairn Info

:max_bytes(150000):strip_icc()/taxes-5bfc47be46e0fb0026623559.jpg)

Tax Shield Definition Formula For Calculation And Example

Tax Shield Definition Formula For Calculation And Example

Interest Tax Shield Explained Why How Does It Work Fervent Finance Courses Investing Courses

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Interest Tax Shields Use Interest Expense To Lower Taxes

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Finance

Full Article Do Personal Taxes Destroy Tax Shields A Critique To Miller S 1977 Proposal

Tax Shield Meaning Importance Calculation And More

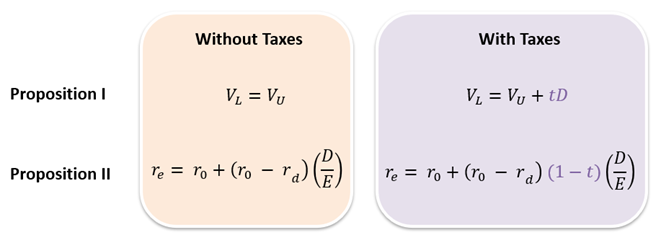

Modigliani Miller Propositions Analystprep Cfa Exam Study Notes

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities